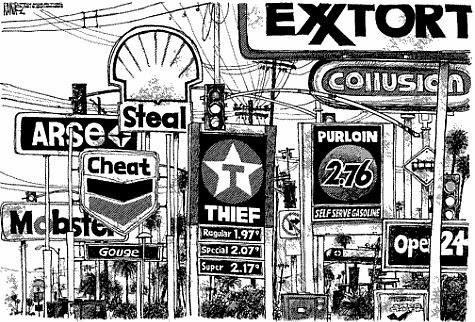

Gasoline prices have hit a seven-year high in the US due to the rising cost of oil, with Americans now paying about $3.40 for a gallon of fuel compared with around $2.10 a year ago.

Oil and gas companies made a combined $174bn in profits in the first nine months of the year as gasoline prices climbed in the US.

The bumper profit totals show that in the third quarter of 2021 alone, 24 top oil and gas companies made more than $74bn in net income.

From January to September, the net income of the group, which includes Exxon, Chevron, Shell and BP, was $174bn.

Exxon alone posted a net income of $6.75bn in the third quarter, its highest profit since 2017, and has seen its revenue jump by 60% on the same period last year.

The company credited the rising cost of oil for bolstering these profits, as did BP, which made $3.3bn in third-quarter profit.

“Rising commodity prices certainly helped,” Bernard Looney, chief executive of BP, told investors.

The analysis of major oil companies’ financials shows that 11 of the group gave payouts to shareholders worth more than $36.5bn collectively this year.

While a dozen bought back $8bn-worth of stock.

New oil drilling has made the US awash with oil in recent years, turning the country into a top-level exporter as well as domestic supplier, but this has kept prices low to the displeasure of investors. “A lot of this has been driven by investor sentiment,” said Helima Croft, head of global commodity strategy at RBC Capital Markets, of the current reluctance to expand production. “They don’t want them to spoil the party.”

“It’s not the government that is banning them from drilling more,” Pavel Molchanov, an analyst at Raymond James, told CNN. “It’s pressure from their shareholders.”

No comments:

Post a Comment