Lenders are poised to take back more homes this year than any other since the U.S. housing meltdown began in 2006. About 5 million borrowers are at least two months behind on their mortgages and more will miss payments as they struggle with job losses and loans worth more than their home's value, industry analysts forecast.

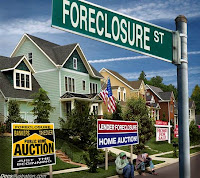

Lenders are poised to take back more homes this year than any other since the U.S. housing meltdown began in 2006. About 5 million borrowers are at least two months behind on their mortgages and more will miss payments as they struggle with job losses and loans worth more than their home's value, industry analysts forecast.RealtyTrac Inc predicts 1.2 million homes will be repossessed this year by lenders. The outlook comes after banks repossessed more than 1 million homes in 2010. One in 45 U.S. households received a foreclosure filing last year, or a record high of 2.9 million homes. Nevada posted the highest foreclosure rate in 2010. One in every 11 households received a foreclosure filing last year in the state. One in every 17 Arizona households got a foreclosure filing last year, while one in 18 received a notice in Florida.

No comments:

Post a Comment